What is an umbrella company?

An umbrella company is a separate entity that gives self-employed contractors a legal employee status and handles all the paperwork. When a contractor joins an umbrella company, the company becomes their employer. Many umbrella companies in the UK employ contractors who work on temporary contract assignments.

Umbrella companies have flourished in the UK due to several reasons. One of these reasons is the IR35, which describes two sets of tax legislation designed to combat tax avoidance by worked and the firms hiring them. Umbrella companies allow contractors to become their employee to compensate for the provisions of the IR35.

How do umbrella companies work?

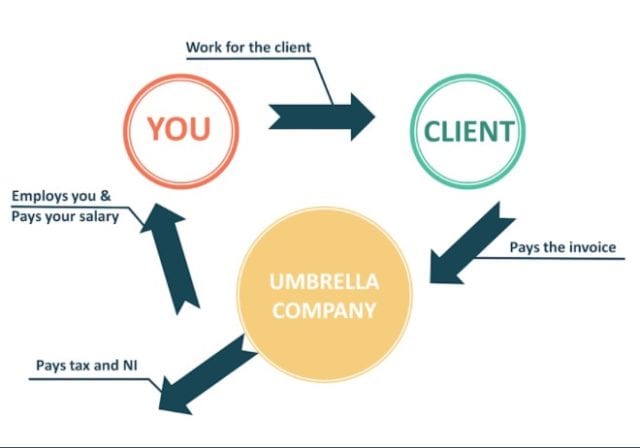

An umbrella company signs contracts with recruitment agency, or the end client, on behalf of a contractor, who will carry out the assignment. It is because recruitment agencies usually prefer to deal with companies as opposed to contractors directly to reduce their liability. On the other hand, the company also signs a contract of employment with the contractor.

The umbrella company also processes the timesheet of the contractor for the job that they must fill or complete during the process. The timesheet shows the hours worked by the contractor for a specific job. Once they fill the timesheet, they must present it to their manager to approve. The contractor, then, has to provide a copy of the timesheet to both the umbrella company and the recruitment agency.

Using the timesheet, the umbrella company invoices the recruitment agency. Subsequently, the recruitment agency bills the end client. It may take some time for the end client to pay for the recruitment agency, which may take even further time to pay the umbrella company.

Once the company receives a payment from the recruitment agency, the umbrella company pays the contractor through PAYE, deducting tax and National Insurance Contribution for them. Similarly, the company can also obtain income tax relief against expenses borne during the contract work, such as travel, food, accommodation, material, etc.

Lastly, the contractor receives a pay-slip, which contains details of their payment along with any deductions made through the PAYE system.

The primary role of an umbrella company in facilitating contractors is to act as an intermediary between a contractor and a recruitment agency and provide payroll services. The company also processes timesheets for its employees and their payments. Similarly, it calculates and makes any deductions on an employee’s behalf from their salary. Furthermore, it can help identify and claim any allowable expenses for the contractor.

Umbrella company Advantages & Disadvantages

There are some advantages and disadvantages of umbrella companies for contractors. While these are some of the top advantages and disadvantages, they do not represent an exclusive list.

Advantages

First and foremost, the biggest advantage of umbrella companies is that it complies with the UK’s tax laws and HMRC regulations. Therefore, these companies, or the contractors working with them, don’t face the risk of an investigation, especially under IR35. However, the umbrella company must comply with the rules and regulations itself for contractors to benefit from this advantage.

Similarly, registering with an umbrella company is a hassle-free process. Contractors, looking for umbrella companies to work with, can find various companies and join them with few requirements. Usually, these companies only need some personal information, which is a legal requirement. Apart from this, the process is relatively straightforward.

Umbrella companies are also low-cost. While these companies deduct a margin from the gross pay of contractors, the percentage is relatively low. In comparison to the services these companies provide, the costs are negligible. As mentioned above, contractors can choose from various companies, so, they can find ones with the lowest margins with a little research.

Umbrella companies also come with highly flexible terms and conditions. Contractors don’t need to pay any joining or leaving fees, which adds to the low costs of the company. Due to this, contractors can join or leave an umbrella company without having to worry about consequences. It gives them the flexibility to use the company whenever they need.

Apart from these, umbrella companies also come with several other advantages. These many include low administration costs compared to running a limited company. Similarly, contractors can enjoy employee benefits that they wouldn’t otherwise get from working individually.

Disadvantages

Despite its many advantages, umbrella companies also come with several disadvantages. When using umbrella companies, contractors have to conform to PAYE regulations, such as paying taxes and NIC. For some contractors, it may not be an attractive option. Contractors also can’t control their finances as the umbrella company makes the deductions before paying them.

Working under umbrella companies may not be as tax-efficient either, compared to owning a limited company. Working as a limited company, contractors can get paid through a combination of salaries and dividends, allowing for better tax planning as compared to when paid through salary only. These contractors may lose 30-40% of their earnings working under the umbrella company.

Similarly, the way that umbrella companies work, contractors may need to wait a long time before getting their salaries. As mentioned, it is because the process involves payments getting approved by the end client and the recruitment agency first. Then, the umbrella company must make the relevant deductions. Any delay in either process can lengthen the overall process of getting paid.

Some umbrella companies also exploit their workers through misleading offers. Many umbrella companies lure in contractors by offering them inflated payments. Most umbrella companies operate under similar rules and regulations, so, offering contractors higher payments is not an option they can provide.

Umbrella companies also have several other disadvantages. For example, while these companies offer employee benefits, the benefits are not as good as what permanent employees get. Similarly, while contractors can claim their expenses using umbrella companies, there are restrictions to the process which significantly reduce the amount contractors can claim.

Umbrella companies & IR35

The purpose of the IR35 is to target individuals who operate through their own limited companies, while still working under the same conditions as regular employees. Therefore, any contractor working in the same manner as employees and not declaring it come under the regulations of the IR35. These contractors end up losing the tax benefits that they get from working through limited companies and may face penalties.

That is where umbrella companies play a vital role. Most contractors, to avoid the regulations of the IR35, opt to work with umbrella companies instead of establishing their own limited companies. Umbrella companies, as mentioned above, treat the contractors as employees. Therefore, these companies can help contractors avoid the regulations of the IR35.

How to choose an umbrella company?

Choosing an umbrella company may sound like a straightforward process, but it is not. Before starting the process, contractors need to evaluate whether an umbrella company is the right trading solution for them. Once they make the decision, they must make a list of all their available options and research about them.

Contractors should also do some background check on these companies to ensure they don’t have a questionable past. Most importantly, however, contractors should evaluate the umbrella companies based on the fees they charge. It is one of the decisive factors when choosing the right umbrella company. As mentioned above, contractors should beware of umbrella companies that offer prices that are too good to be true.

Subsequently, contractors must ensure they receive a full contract of employment when signing with these companies. They should also research about other aspects of their engagement, such as the process of claiming expenses, the timing of payments, whether the umbrella company’s services include tax paperwork, the joining or leaving fees involved, how much help and support the companies provide, etc.

Using that information, contractors can easily select the right umbrella company for their needs. The process may take longer. However, it is worth the effort at the end.